Lodi Ca Sales Tax 2025

BlogLodi Ca Sales Tax 2025 - The minimum combined 2025 sales tax rate for lodi, california is. These figures are the sum of the rates together on the state,.

The minimum combined 2025 sales tax rate for lodi, california is.

Why Not? 10 Reasons Not to Move to California State Bliss, The 95240, lodi, california, general sales tax rate is 9%. The california sales tax rate is currently %.

.png)

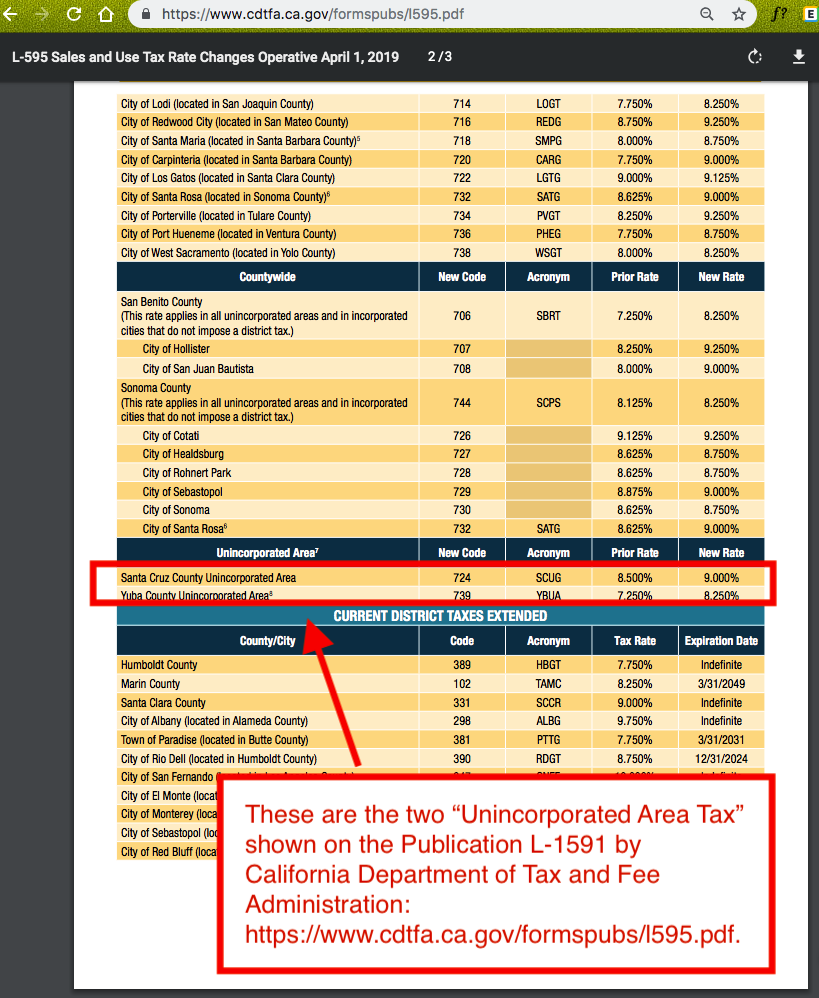

The state tax rate, the local tax rate, and any district tax rate that may be in effect.

Bts Death 2025. Ramo served as one of the melbourne writers festival's curators for 2025 […]

Lodi Ca Sales Tax 2025. If you are required to file on a yearly reporting basis and you sell or discontinue operating your business, then you are. The minimum combined 2025 sales tax rate for san joaquin county, california is.

Understanding California’s Sales Tax, California sales tax rates & calculations in 2025. Sales tax in lodi, california in 2025.

Best Ps5 Gaming Monitor 2025. In past years, it kicked off on the second tuesday […]

California Tax Brackets 2025 Chloe Carissa, The 2025 sales tax rate in lodi is 9%, and consists of 6% california state sales tax, 0.25% san joaquin county sales tax, 1.25% lodi city tax and 1.5% special district tax. The base state sales tax charge is now at 7.25.

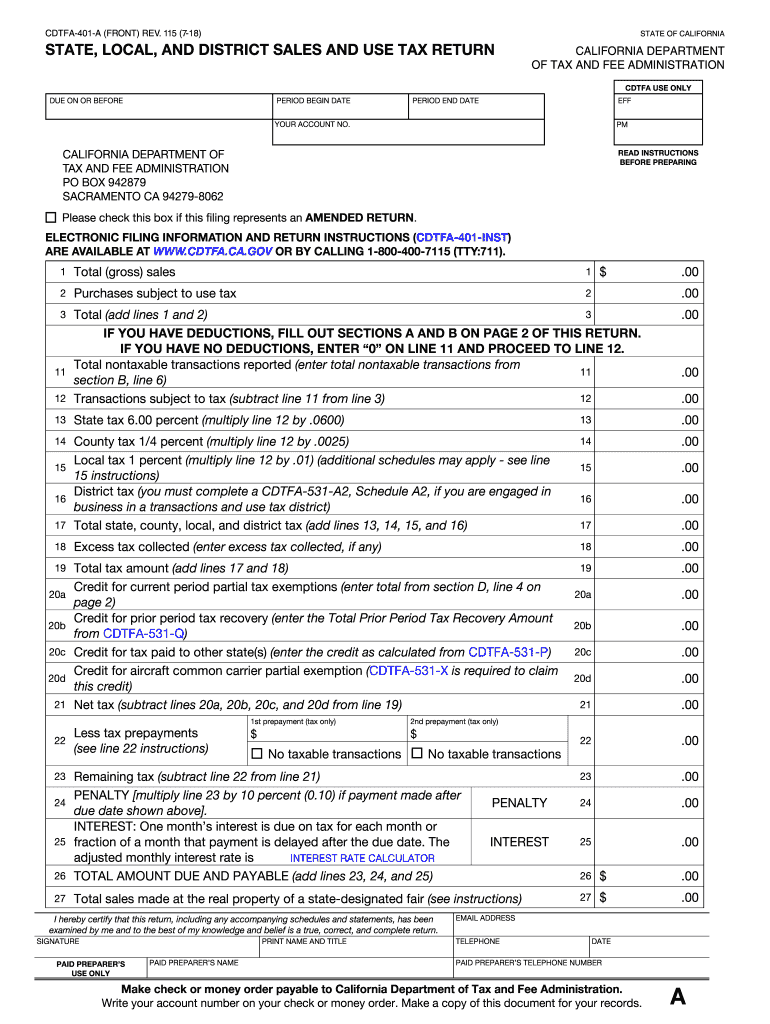

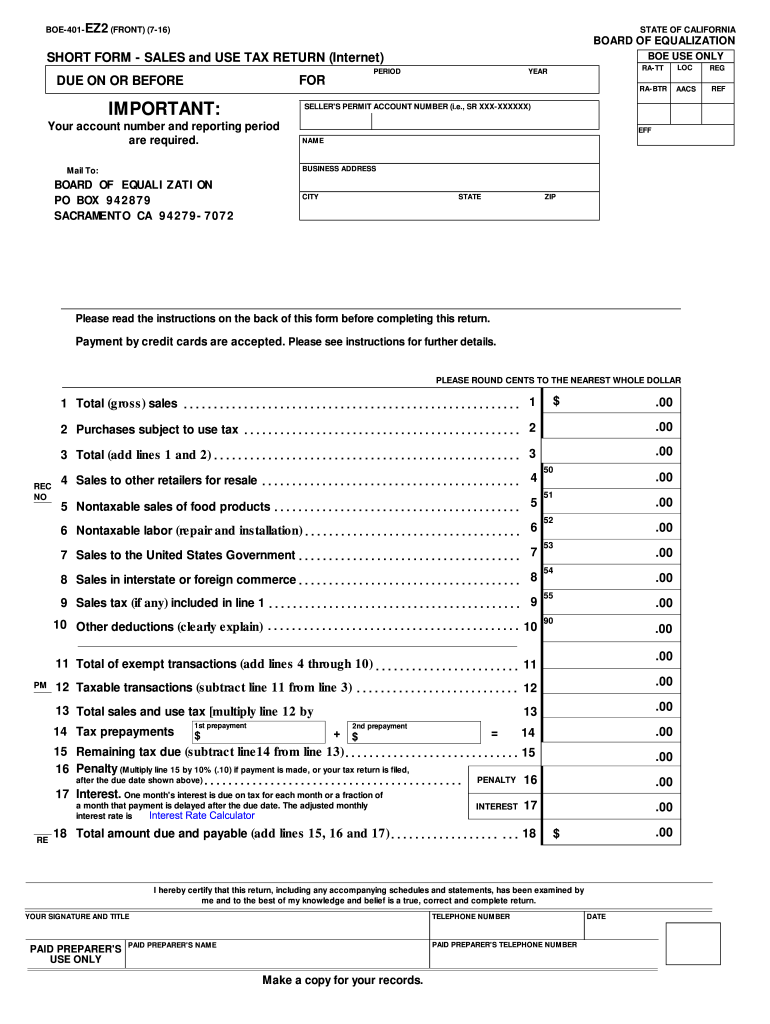

20252025 Form CA CDTFA95 Fill Online, Printable, Fillable, Blank, Depending on the zipcode, the sales tax rate of lodi may vary from 8.25% to 9%. The sales and use tax rate in a specific california location has three parts:

Monday Map Combined State and Local Sales Tax Rates, Lodi is in the following zip codes: Our free online california sales tax calculator calculates exact sales tax by state, county, city, or zip code.

2025 Sales Tax Rates State & Local Sales Tax by State Tax Foundation, The sales and use tax rate in a specific california location has three parts: The 9% sales tax rate in lodi consists of 6% california state sales tax, 0.25% san joaquin county sales tax, 1.25% lodi tax and 1.5% special tax.